2023 Medical Insurance

Dartmouth offers a choice of three different medical plans. All three plans include prescription drug coverage and preventive vision care. The medical plans are self-insured and administered by Cigna Health and Life Insurance Company (Cigna). Pharmacy benefits are administered by Express Scripts.

Contact Cigna Health

- 855-869-8619

- https://www.cigna.com/

- https://my.cigna.com

Create an AccountCigna manages your Cigna manages all three of Dartmouth's medical

plans and the HRA accounts when electing the CCF or HDHP with HRA medical plan options. By creating an account through mycigna.com you will be able

to track claims, order ID cards, find doctors, compare costs, and track account balances.1.

Go to http://mycigna.com

2. Click on REGISTER

3. Make sure you have your Cigna ID or Social Security number available

4. Click START REGISTRATION

5. Enter your Name, Date of Birth and zip code

6. Answer a question about your membership

7. Enter your ID card number or SSN

8. Enter your zip codeEligibility and EnrollmentAll employees who meet Dartmuoth's

benefits eligibility guidelines are eligible to enroll in one of Dartmouth's three

medical plan options through Cigna Health. But it is important to know that monthly

rates can vary based on annual salary and hours worked. Pharmacy and Vision coverage

come with the medical plan that you choose.New Hires may enroll in medical insurance

within their first 30 days of enrollment, otherwise existing employees may enroll durng the annual open enrollment period

held each fal for a January 1st start date. If you do not log in and elect or waive

medical insurance as a new employee, you will be defaulted into the Cigna Choice Fund (CCF) plan at the employee only coverage level. Some

qualified life events causing a drop in external medical insurance will allow for

enrollment in a medical plan for yourself and/or your dependents outside of the annual

open enrollment window. Qualified life events must be completed in the FlexOnline system with 30 days of the event.ID CardsPlease allow 7-14 days from new hire enrollment for new ID cards to arrive

in the mail. You will receive an ID card for each covered member of your family.

If you lose your ID card, please contact Cigna directly at the number above, or you

may access a copy through the Cigna mobile ap.Top of PageCOVID Related Treatment & TestingAll of Dartmouth's active employe and retiree health

plans will cover covid related treatment and testing, at 100% through June 30, 2023.

Testing will only be covered at 100% when ordered by your medical provider, and when

covid related symptoms are present or when you have had a confirmed exposure.Understanding

your Health PlanInsurance can be confusing – Please review the Understanding your Health Plan webpage for general information, forms, and definitions before starting the medical

plan selection process.The PlansDartmouth offers a choice of three different medical

plans. To learn more about a specific plan, please click on one of the links below.

- Open Access Plus Plan (OAP)

- Cigna Choice Fund Plan (CCF)

- High Deductible Health Plan (HDHP)

- Medical Plan Comparison Chart

Top of PageAll Three Plans Offer...Before you try to determine the differences between the three health plan options, here are are some similarities across the three plans that you should be aware of:

- Coverage by Cigna Health

- Coverage for medical care, including visits to your doctor's office, hospital stays, mental health and substance abuse services, chiropractic treatment, physical therapy and other services.

- An option to choose a primary care doctor to help guide your care. It's recommended, but not required.

- A national network of providers (Open Access Plus/Carelink), as well as emergency coverage when traveling abroad for personal travel. More information on coverage while travleing abroad.

- No referral is needed to see a specialist, although pre-certification may be required.

- In-network preventive care* services covered at no additional cost to you. Refer to the Summary of Benefits under each plan for a list of covered preventive care services.

- 24-hour emergency care, in- or out-of-network.

- Limits on what you'll pay out-of-pocket. Once you spend the annual out-of-pocket maximum amount, the medical plan pays your covered health care costs at 100%.

- No copay or coinsurance (depending on the plan) for care received through Cigna Telehealth Connection.

- No-claim paperwork is necessary when you receive care in-network.

- Access to Dartmouth Health Connect (now One Medical at Dartmouth) (except when contributing to an HSA).

- Each family member pays toward their own individual deductible and out-of-pocket maximum. Family limits are in place to help minimize the total amount of deductibles and out-of-pocket maximums that your family would have to pay in a given year.

- The ability to manage and track claims, order ID cards, find doctors, and track account balances through the myCigna.com website.

- Medical plan rates are deducted from your paycheck pre-tax. Research Fellows pay on

a post-tax basis.

*Some preventive services may not be covered. For example, immunizations for travel are generally not covered. Other non-covered services/supplies may include any service or device that is not medically necessary or services/supplies that are unproven (experimental or investigational).

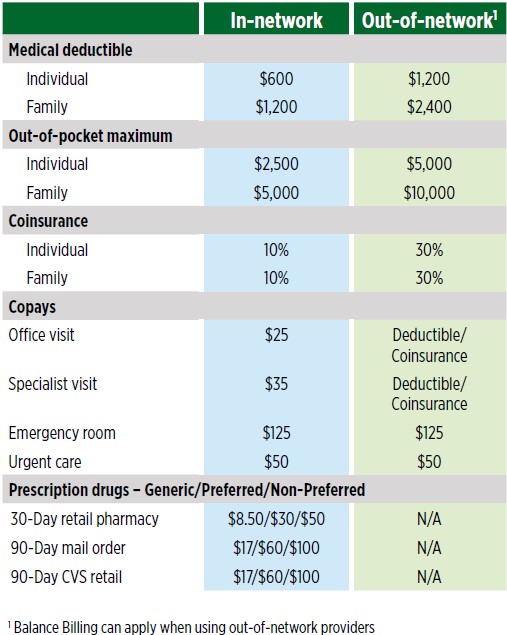

Top of PageOpen Access Plus Plan (OAP)The OAP Summary of Benefits provides a detailed list of covered services.J-VISA holdersIn order to maintain compliance with the Department of State, employees working for Dartmouth under J-VISA status, must be enrolled in a health plan that meets specific coverage requirements. The only plan available to J-VISA holders is a special Open Access Plus plan with a $500 deductible. This plan matches the $600 OAP plan in coverage, pharmacy services, vision services and premium cost, but has a lower deductible. Please see the JVISA Summary of Benefits provided for a detailed list of covered services. Monthly premium costs match that of the OAP plan on the Benefit Cost Estimator.Key Benefits on the OAP medical plan

- The deductible and medical copays are the lowest of the three plans.

- If you enroll in the OAP Plan, you can also participate in a Health Care FSA (HCFSA), and or receive a Dartmouth contribution if eligible.

- Dartmouth Health Connect (now One Medical at Dartmouth) is available as a primary care provider option.

Other Considerations

- The OAP has the highest rates of all three plans.

- Medical and prescription copays DO NOT count toward annual deductibles, but DO count toward annual out-of-pocket maximums.

- This is the only plan available to J-VISA holders

- This plan has additional hearing aid coverage.

Plan OverviewSee page 11 of the 2023 Open Enrollment Guide for a larger view of these charts Top of PageCigna Choice Fund Plan (CCF)The CCF Summary of Benefits provides a detailed list of covered services.Key Benefits on the CCF medical plan

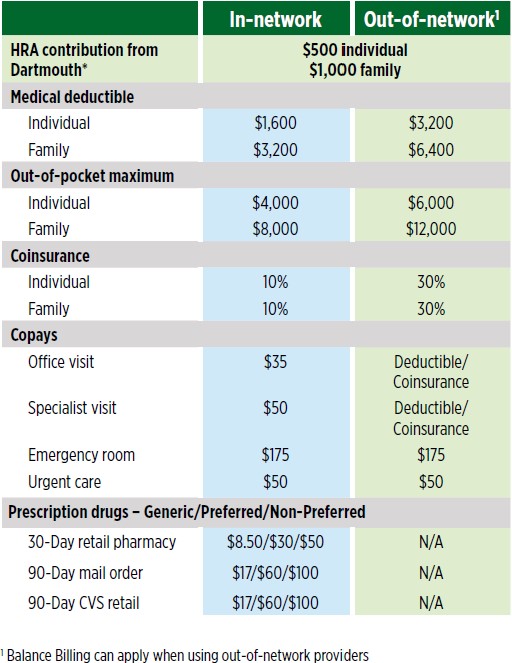

Top of PageCigna Choice Fund Plan (CCF)The CCF Summary of Benefits provides a detailed list of covered services.Key Benefits on the CCF medical plan

- The deductible and copays are mid-level.

- Employer contributes to an HRA.

- Employee may contribute to an HCFSA.

- Dartmouth Health Connect (now One Medical at Dartmouth) is available as a primary care provider option.

Other Considerations

- Medical and prescription copays DO NOT count toward annual deductibles, but DO count toward annual out-of-pocket maximums.

Plan OverviewSee page 12 of the 2023 Open Enrollment Guide for a larger view of these charts. Top of PageHigh Deductible Health Plan (HDHP)The HDHP with HRA Summary of Benefits provides a detailed list of covered services.

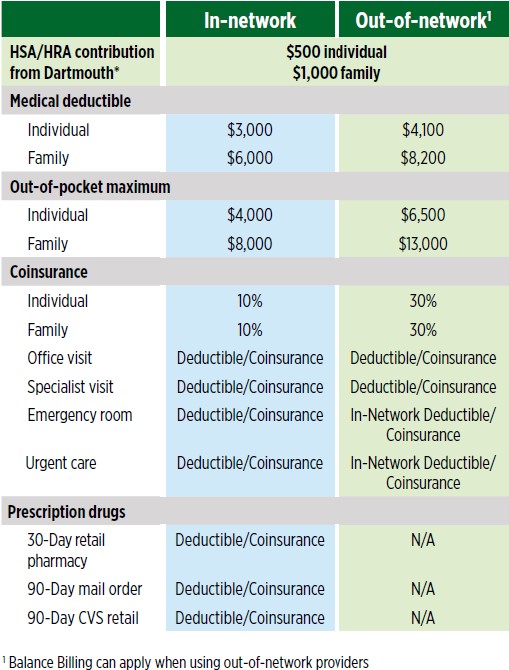

Top of PageHigh Deductible Health Plan (HDHP)The HDHP with HRA Summary of Benefits provides a detailed list of covered services.

The HDHP with HSA Summary of Benefits provides a detailed list of covered services.Key Benefits on the HDHP medical plan

- The plan has the lowest rates of all three plans.

- Employer may contribute to an HRA or HSA – this is the only plan that allows HSA contributions.

- Employees may contribute to an HCFSA when electing HDHP with HRA.

- Dartmouth Health Connect (now One Medical at Dartmouth) is available as a primary care option for employees with an HRA.

Other Considerations

- This plan has the highest deductible of the three plans.

- You pay 100% of all medical and prescription costs until your annual deductible has been met.

Plan OverviewSee page 13 of the 2023 Open Enrollment Guide for a larger view of these charts. Top of PageBehavioral Health BenefitsTraditional Behavioral Health counseling is available through

your Cigna health plan at the cost of a Primary Care Physician (PCP) copay on the

OAP and CCF plans while costs are subject to plan deductibles and coinsurance on the

HDHP plans.Out-of-Network Behavioral Health Providers:Dartmouth College recognizes

that there are a limited number of mental health providers in the Upper Valley who

participate with health insuance carriers. To improve access to behavioral health

care for Dartmouth employees and their families, Dartmouth has worked closely with

Cigna to increase the number of Cigna participating providers in the Upper Valley,Mental Health Exception Benefit: Dartmouth has developed a behavioral health exception benefit program for those

enrolled in one of Dartmouth's medical plans and are using out-of-network providers.

This benefit will cover the first 12 out-of-network behavioral health provider visits

at 90% of billed cost with no balance billing. For more information please visit

our behavioral health webpage.NEW! Starting January 1, 2023, once a member has exhausted the Mental Health Exception

Benefit, all future out-of-network behavioral health visits will be processed at the

plans in-network deductible/coinsurance or copay amounts (balance billing may apply).

This change is in recognition of the ongoing difficulty of receiving in-network behavioral

health services in our area.For additional emotional support tools and resources,

like the Faculty/Employee Assistance Program, virtual behavioral care options, free

apps, videos and other helpful resources, please visit Wellness at Dartmouth.Top of PageTelehealthCigna Telehealth is a resource that allows you to connect with board-certified

MDLIVE doctors for help with minor, non-life threatening conditions through secure

video, chat or phone 24/7/365, including holidays! If you are enrolled in the Cigna

Open Access Plus plan or the Cigna Choice Fund plan, there is no copay for urgent

care services. Telehealth services for primary care and specialty care will be billed

at the copay rate on the OAP and CCF plans. If you are enrolled in the Cigna High

Deductible Health Plan, the cost is $55 for urgent care services. Costs for primary

and specialty care services on the HDHP may differ by service. Get the care you need,

including most prescriptions (use of this service does not guarantee that a prescription

will be written.)You can visit your www.mycigna.com to register at TeleHealth in anticipation of future use. By registering ahead of

time, the process will not be delayed when you need to utilize this benefit.About Telehealth

Top of PageBehavioral Health BenefitsTraditional Behavioral Health counseling is available through

your Cigna health plan at the cost of a Primary Care Physician (PCP) copay on the

OAP and CCF plans while costs are subject to plan deductibles and coinsurance on the

HDHP plans.Out-of-Network Behavioral Health Providers:Dartmouth College recognizes

that there are a limited number of mental health providers in the Upper Valley who

participate with health insuance carriers. To improve access to behavioral health

care for Dartmouth employees and their families, Dartmouth has worked closely with

Cigna to increase the number of Cigna participating providers in the Upper Valley,Mental Health Exception Benefit: Dartmouth has developed a behavioral health exception benefit program for those

enrolled in one of Dartmouth's medical plans and are using out-of-network providers.

This benefit will cover the first 12 out-of-network behavioral health provider visits

at 90% of billed cost with no balance billing. For more information please visit

our behavioral health webpage.NEW! Starting January 1, 2023, once a member has exhausted the Mental Health Exception

Benefit, all future out-of-network behavioral health visits will be processed at the

plans in-network deductible/coinsurance or copay amounts (balance billing may apply).

This change is in recognition of the ongoing difficulty of receiving in-network behavioral

health services in our area.For additional emotional support tools and resources,

like the Faculty/Employee Assistance Program, virtual behavioral care options, free

apps, videos and other helpful resources, please visit Wellness at Dartmouth.Top of PageTelehealthCigna Telehealth is a resource that allows you to connect with board-certified

MDLIVE doctors for help with minor, non-life threatening conditions through secure

video, chat or phone 24/7/365, including holidays! If you are enrolled in the Cigna

Open Access Plus plan or the Cigna Choice Fund plan, there is no copay for urgent

care services. Telehealth services for primary care and specialty care will be billed

at the copay rate on the OAP and CCF plans. If you are enrolled in the Cigna High

Deductible Health Plan, the cost is $55 for urgent care services. Costs for primary

and specialty care services on the HDHP may differ by service. Get the care you need,

including most prescriptions (use of this service does not guarantee that a prescription

will be written.)You can visit your www.mycigna.com to register at TeleHealth in anticipation of future use. By registering ahead of

time, the process will not be delayed when you need to utilize this benefit.About Telehealth

Telehealth Behavioral Health Services

MD Live App InstructionsVirtual Health VisitsVirtual health visits can be obtained with both in- and out-

of-network providers who are not part of Cigna's MDLIVE Telehealth program. Virtual

health visits are billed in the same manner as in-office visits. Virtual health visits

with international providers are not covered on any of the health plans.Cancer Support ProgramWhether you have cancer - or are a cancer survivor, you can

get one-on-one support with the Cigna Cancer Support Program. From understanding

your diagnosis to discussing your health care provider's treatment to celebrator your

surviorship, Cigna is here to support you and your family throughout your journey,

and help you get the care you need. The Cigna Cancer Support program is part of your

health plan and is offered at no extra cost to you. The specialists who help customers

in this program have experience as oncology nurses. More information on Cigna's Cancer Support program.OMADA for Pre-DiabetesOMADA is free digital behavioral change program focused on pre-diabets

and metabolic syndrome and is offered to members enrolled in a Dartmouth Cigna health

plan. The program is designed to help members lose weight and avoid chronic illnesses.

Participants receive personalized virtual support along with a digital scale, professional

health coaching, social support groups and online training lessons.View more information

on the OMADA Program.Top of PagePlan CostsHealth care is a shared expense between the College and employees. It is

important to understand that there is a per pay period cost to have your health insurance

this is referred to as the premium or rate. Then there is a and then a separate cost

to use services through your providers. These costs are usually referred to as deductibles,

coinsurance and copayments. To fully understand the costs that you will be responsibile

for, please review our Understanding your Health Plan webpage.Once you have an understanding of how the three medical plans work and the differences

between them, you can use the benefit plan cost estimator to see how much you will pay out of pocket for each of the three plans.Choosing a

PlanEmma is an online assistance tool that is incorporated in the FlexOnline benefits

enrollment system, that can help you with the medical plan decision making process.

Emma takes the annual cost to have a medical plan and adds the estimated cost of

what you might spend to use your health plan (based on your anticipated service usage

during the calendar year), and lets you know which medical plan she believes might

be most cost effective for you. Please note: Emma is not the ultimate decision maker,

you are. So please feel free to try various scenarios and see if Emma changes her

selection, but remember, ultimately, the final decision is yours.Top of PageProvider LookupUse the links below to find local medical and behavioral heal care

providers within Cigna's national network. Look for the "Open Access Plus/Carelink"

network.Medical Providers

Behavioral Health ProvidersFiling Out-of-Network Claims

- In-Network - When using Cigna's in-network providers, these providers are required to file your medical claims directly with Cigna on your behalf. The provider will submit the claim to Cigna, Cigna will process the claim and pay the provider. The provider will then send you a bill for the remaining portion of deductible, coinsurance or copay that is your responsibility.

- Out-of-Network – Your health plan provides coverage for services from doctors and facilities that

are not in your plan’s network. But if you do receive covered out-of-network care,

your share of the costs (i.e. deductibles, copays or coinsurance) will usually be

higher than if you receive those services in-network. There is a limit to the amount

your plan will pay for covered out-of-network services called the maximum reimbursable charge (MRC). An out-of-network doctor or facility can bill you directly for any amount above

your plan’s MRC. This is often referred to as “balance billing.” You will be responsible

for paying that amount and these payments do not apply to your deductible or out-of-pocket

maximum.

Medical Claim Form

Behavioral Health Claim FormTop of PageLeaving DartmouthCOBRA ContinuationYour medical insurance benefits will end on the

last day of the month in which you end employment or last day of the month in which

you are no longer benefits eligible with Dartmouth College. If are under age 65 and

not Medicare eligible, you will be offered continuation of coverage through your rights

under the Consolidated Omnibus Budget Reconcilliation Act. For complete information

and answers to frequently asked questions about COBRA please visit our Leaving Dartmouth webpage.What If I Need To Use Medical Services Prior to Receiveing/Returning My COBRA packet?Explain

to your provider that you have left your employment or are no longer eligible for

benefits at Dartmouth College, and that you are in the process of enrolling in COBRA.

Most providers will send a bill to your home, which you can later call and have the

claim re-submitted once the COBRA coverage has been established. If you have upcoming

services that require a prior authorization, please contact the Benefits Office at

603-646-3588 for an expedited enrollment.What If I Need a Prescription Prior to Receiveing/Returning

My COBRA packet?Prescription drugs must be paid out of pocket, and will only be reimbursed

at the Express Scripts "allowed" amount. However, most pharmacies will reimburse the

overpayment, if you return within 14 days with your pharmacy ID number and original

receipt. Please speak with your pharmacy about their process in these cases and what

they will allow. If you have an urgent situation, please contact the benefits office

at 603-646-3588.Transitioning to other coverageIf you take regular maintenance medications,

we highly encourage you to fill a 30 to 90 day prescription just prior to your coverage

ending here at Dartmouth. This will allow time for your new coverage to be established

before having to request your next refill.Top of Page