2023 Health Care FSA

Allows you to use pre-tax dollars to pay eligibe health care expenses not covered by your medical or dental plan.

Contact Sentinel Benefits

888-762-6088

https://www.sentinelgroup.com/

Sentinel Help Center

781-213-7301 (claims)

Create an Account

Set up your account with Sentinel and download the mobil app

1. Go to www.sentinelgroup.com (Chrome and Safari are the recommended browsers)

2. In the "I am an Individual" section, click on GET STARTED

3. From the LOGIN drop down, select "FSA, HSA, HRA, Commuter Accounts"

4. Under NEW USER select "Create your new Username and Password"

5. Enter your personal information

In addition, you can also upload the Sentinel Accounts App onto your mobile phone for ease in claim monitoring and claim submission.

For more information, watch this helpful video from Sentinel on how to navigate your online account. https://help.sentinelgroup.com/help/navigating-your-online-account

Eligibility and Enrollment

- All benefits-eligible Faculty, Exempt, Non-Exempt and SEIU employees are eligible to contribute.

- Research Associate Bs and Research Fellows are not eligible to participate in the HCFSA.

- Those who are eligible to receive medical-expense reimbursement under your own Health Savings Account (HSA) or that of a spouse or parent are NOT eligible to contribute to or recieve employer funds in a General Purpose HCFSA.

During your New Hire and Annual Enrollment you will be asked two prequalifying questions in FlexOnline as to whether you or any IRS dependents are contributing to or receiving employer funds in a Health Savings Account (HSA). If you answer yes to these questions (answer must be the same for both), you will not be able to enroll in a Health Care FSA account for the calendar year in which you are enrolling.

Anyone waiving Dartmouth coverage or those enrolling in the OAP, the CCF or the HDHP with HRA medical plan options may also contribute up to the maximum in a HCFSA plan. Unlike the HSA, New Hires you can elect the annual limit even if you have already contributed to and spent HCFSA funds through a former employer, or if other household members have met their annual limit.

IMPORTANT NOTE: If you do not elect a contribution amount during your New Hire enrollment or during your annual open enrollment period, you will not be able to contribute to a Health Care FSA for the calendar year, unless you have a very specific type of qualified life event. Changes to your annual election can only be made during very specific life event circumstances as well.

Contribution Limits

HCFSA Annual Limits

Annual Limit per employee: $3,050.

- This limit is per individual, so couples can each enroll in an HCFSA and contribute the maximum.

- If you are new to Dartmouth and contributed to a HCFSA through your former employer, you may still contribute the annual maximum through Dartmouth.

- Unlike an HSA, all carryover balances and employer contributions can be added to the annual limit.

- If you elected the 2022 maximum of $2,850 during open enrollment and the limits increased after that time, the benefits office will email you with an offer to increase your limit to the new maximum. Please watch your email for this notice.

Important Filing Deadlines

12/31/22 - Last day to incur eligible expenses for 2022, when switching to an HSA in 2023.

1/1/23 - Stop using your Benny card to pay for eligible 2022 incurred HCFSA expenes. After

this point, 2022 incurred claims must be submitted manually unil the 3/31/23 deadline.

3/31/23 - FSA Runout Period Ends - Last day to submit 2022 incurred HCFSA claims to Sentinel

for reimbursement. You will still be able to submit 2023 incurred HCFSA claims after

this point, but they will be applied toward your 2023 elections and carryover balances.

4/1/23 - No more 2022 incurred claims will be accepted by Sentinel. Any remaining 2022

balance greater than the allowed carryover amount will be forfeited.

You do not need to report FSA contributions or expenditures to the IRS through your annual tax return.

Eligible Expenses

For a list of the IRS's eligible Dependent Care Expenses, please click here.

Understanding the Benefits

Flexible Spending Accounts are strictly regulated by the IRS. It is your responsibility to read and understand the information provided. For clarification about information on this webpage, please reach out to the Dartmouth Benefits office. If you have specific questions around the IRS' rules and regulations surrounding your FSA plan, you are advised to speak to your tax professional.

Sentinel has provided a quick start guide, to get you going. For more in-depth information about your plans and how they work, please review the information provided below.

Key Benefits

- Set aside guaranteed pre-tax dollars that you can use during the year to pay for eligible medical expenses.

- The account can be used together with an HRA to help pay for vision and dental expenses, co-pays, and additional deductible and coinsurance amounts that are not covered by the HRA.

- You can use your Sentinel Benefits & Financial Group (Sentinel) Benny debit card to pay for eligible expenses on day one, and even spend leftover HCFSA dollars at thefsastore.com without substantiation.

Employee HCFSA Contributions

- Individuals may contribute up to $3,050 for the calendar year 2023

- If you are coming to Dartmouth from another employer where you contributed to a HCFSA account, you ARE allowed to contribute the full limit amount through Dartmouth.

- Although the annual limit is $3,050, unlike HSA's the IRS does allow employer HCFSA contributions and HCFSA carryover dollars on top of the individual contribution limits.

Employer HCFSA Contributions

You may be eligible for a Dartmouth contribution of up to $250 per calendar year if you:

- Are Non-Exempt or SEIU; OR are Faculty or Exempt and making $60,000/year or less; AND

- Select the OAP medical plan OR elect no medical coverage.

- The amount received is prorated based on your date of hire (if newhire/rehire) and your Full Time Equivalency (FTE)

Dependents

You are permitted to use your HCFSA plan to pay for eligible healthcare expenses for you and your eligible dependents. In general an eligible dependent is:

- Your Spouse

- Your dependent that you can claim on your tax return

- Your adult child(ren) who is under the age of 27.

A domestic partner is not considered a spouse under federal law, so a domestic partner's

medical expenses cannot be reimbursed under your medical FSA account unless the domestic

partner is a qualifying relative as described above. A qualifying spouse must be legally

married.

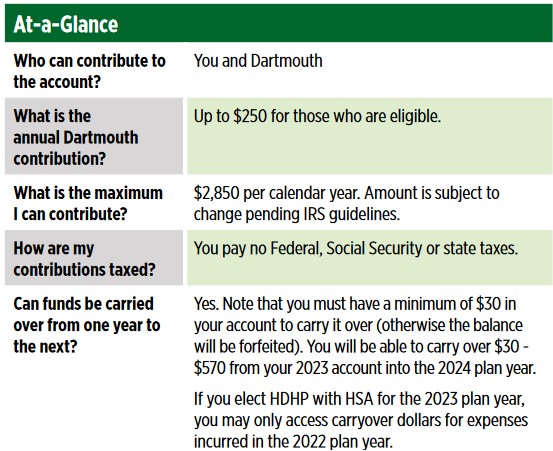

Plan Overview

Refer to page 21 of the 2023 Open Enrollment Guide.

Annual Limit has increased from $2,850 to $3,050 in chart below

Annual Carryover limit has increased from $570 to $610 in chart below.

How the HCFSA Benefit Works

Refer to page 19 of the 2023 Open Enrollment Guide.

HCFSA Payroll Deduction - Money comes out of your pay check each pay period, and goes into your HCFSA Account at Sentinel Benefits, reducing the amount of taxes you pay each pay period.

HCFSA Account is Funded - The full amount that you elect to contribute for the year plus any money that Dartmouth gives you for the year, is all front-loaded into your HCFSA Account as of 1/1/23 (as of benefits eligibility date if new to benefits). This means that the full balance is available for your to start using on day one.

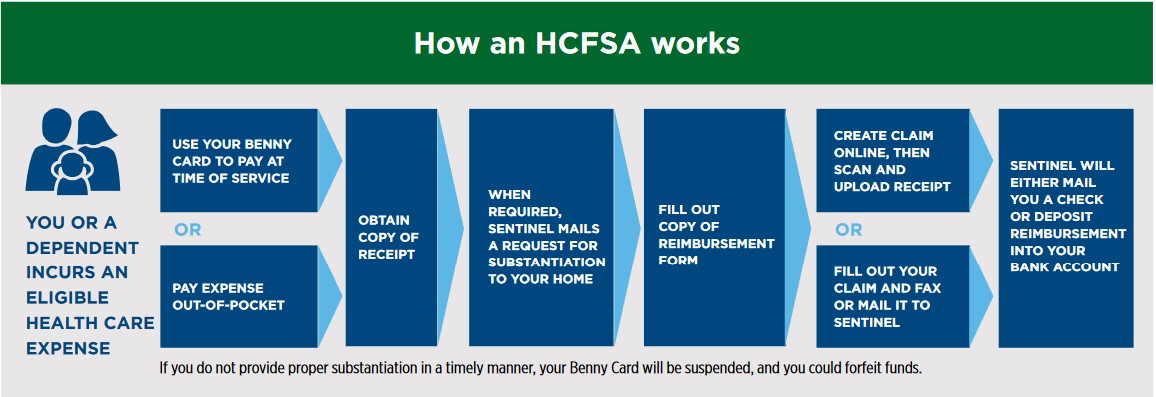

Incur Eligible HCFSA Expenses - If you or an eligible dependent incurs an eligible medical expense that is not covered by your health plan , you can then either pay the bill immediately with your Benny debit card or get reimbursed from the funds in the account.

List of Eligible HCFSA Expenses

List of Ineligible HCFSA Expenses

Keep your HCFSA Receipts - Some expenses will require substantiation as you spend. Keep your receipts for any expense that is paid by your HCFSA.

Submit/File a Claim - Most expenses paid through your HCFSA account will require some form of substantiation as proof to Sentinel and the IRS that the money you spent was on what the IRS considers an eligible expense. Your health care provider, dentist, etc. does not send copies of your invoices to Sentinel Benefits. See the Substantiation and Filing an HCFSA claim sections below.

HCFSA Deadlines - HCFSAs have deadlines regulated by the IRS. Any unclaimed balance remaining in your account at the end of the March 31st run out period will be forfeited. Please pay careful attention to the IMPORTANT FILING DEADLINES section at above.

Tax Reporting - You are not required to report contributed or spent HCFSA funds on your annual tax return. But box 1 of your W-2 does reflect the reduction in wages that were sent to your HCFSA account, reducing your annual tax liability.

HCFSA Carryover

Carryover dollars are unspent dollars remaining in your HCFSA account at year end, that are eligible to "Carryover" and be added onto the following years HCFSA account balance and then spent in the new year. There are minimum and maximum carryover amounts, and any balance remaining in the account above or below the carryover amounts will be forfeited on April 1st of the following year. The minimum carryover balance is $30 going into 2023, and the maximum is $610. If you think you will have excess in your account, we strongly suggest that you spend down any excess amounts from your 2022 account before 12/31/2022. One way to do this is online through thefsastore.com

Claim Substantiation

Before you try to file a claim with Sentinel, it is important to understand what it means to "substantiate" the claim.

Most of the eligible medical expenses that you pay through your HCFSA account will require some form of substantiation as proof to Sentinel Benefits and the IRS that the money you spent was on what the IRS considers an eligible health care expense. Your health care provider, dentist, etc. does not send copies of your invoices to Sentinel Benefits.

Unless the amount is equal to one of Dartmouth's medical or pharmacy plan copay amounts, you will most likely have to submit a copy of the invoice or medical Explanation of Benefits (from Cigna/Delta Dental, etc) as your proof that the claim was for a legitimate IRS approved health care expense.

The IRS does not require that you show proof of payment to receive reimbursement on a bill. They just want to see that the service was incurred on an IRS eligible expense within the calendar year for which the pre-tax dollars were allotted.

Your substantiation document must show the following five pieces of information for approval by Sentinel:

- Your Name

- Name of the Provider

- Date of Service (shows proof that service was incurred during the same calendar year for which the pre-tax dollars were deducted from your paycheck)

- Description of Service (indicating eligible expense)

- Amount of Service (Must match the amount of payment that was made - if Benny card used)

For more information on claim documentation, please review Sentinel's website at https://help.sentinelgroup.com/help/uploading-claim-documentation

FILING A CLAIM

There are three ways to file/submit claims through Sentinel Benefits.

- Benny VISA Debit Card - Use the Sentinel Benny debit card to pay the bill at the time of service. Then submit a copy of receipt or Explanation of Benefits (EOB) to Sentinel after the fact through your online account or through the Sentinel Mobil ap.

- Pay out of Pocket - Pay for the service out of pocket then submit a copy of the receipt or EOB to Sentinel after the fact through your online account or through the Sentinel Mobil ap. Sentinel will reimburse you by check or or via direct deposit (typically within 3-5 business days).

- Unpaid Invoice - Obtain a copy of an unpaid provider invoice or Cigna EOB, submit a copy of the unpaid bill or EOB to Sentinel through your online account or through the Sentinel Mobil ap. Sentinel will reimburse you by way of direct deposit or paper check. You will then have funds available to pay the unpaid invoice.

NOTE: Do not try to use funds from your 2023 HCFSA account to pay for an expense incurred in 2022, unless it is paid from your 2022 carryover balance and before the March 31st submission deadline.

For more information on submitting a claim through the online portal, please check out the following video from Sentinel Benefits: https://help.sentinelgroup.com/help/submitting-an-online-claim

Leaving Dartmouth

Changing Employment Categories - RAB and Research Fellows are not eligible to participate in either of the FSA benefits. If you are enrolled in a HCFSA and move into one of these non-eligible employment categories, you will lose benefit eligibility and the benefit will end and you may choose to continue contributing to it on a post-tax basis under COBRA.

Losing Benefit Eligibility - If you are enrolled in a HCFSA and your Full Time Equivalency decreases below half time, you will lose benefit eligibility and the benefit will end. You may choose to continue contributing to it on a post-tax basis under COBRA.

Debit Cards - Your Sentinel debit card will be deactivated on the day after you lose eligibility for the benefit (see losing benefit eligibility above).

Overspend of Funds - If you have already spent more money than you have contributed by the time your plan coverage ends, you will not be required to pay back the difference.

COBRA - If you have already spent more than the amount that you have contributed year to date (as of the time you become eligible for COBRA), you will not be eligible to continue the HCFSA under COBRA. Otherwise, when you elect to continue your Health Care FSA under COBRA, you may continue to incur expenses and contribute to the account on a post-tax basis, through the end of the plan year in which your employment ends. The plan year ends on December 31st. For more information on Cobra benefits please visit our Leaving Dartmouth webpage.

Runout Period (Deadline to submit claims) - Regardlesso of whether you continue the benefit under COBRA, the Health Care FSA has a three month runout period (through March 31st), that allows you to submit claims for expenses that were incurred during the period within the prior calender year for which your account was active (Typically January 1st through either the last day of the month in which you were benefits eligible OR through December 31st if you continued the benefit under COBRA).

Carryover Feature - If you continue your Health Care FSA under COBRA, unused dollars will not carry over after the runout period ends and the remaining balance in your account will be lost.

Incurring Claims - You may continue to incur claims through the end of the month, in which you leave Dartmouth or lose eligibility for the benefit. If you are eligible to continue the benefit under COBRA, then you may continue to incur claims through the end of the calendar year.

Submitting for Reimbursement - Once your card has been deactivated, claims may be submitted directly to Sentinel by filling out a claim form and sending it via US mail, by using the Sentinel phone app, or by uploading the fo/"rm to your personal account at www.Sentinelgroup.com