2023 Dependent Care FSA

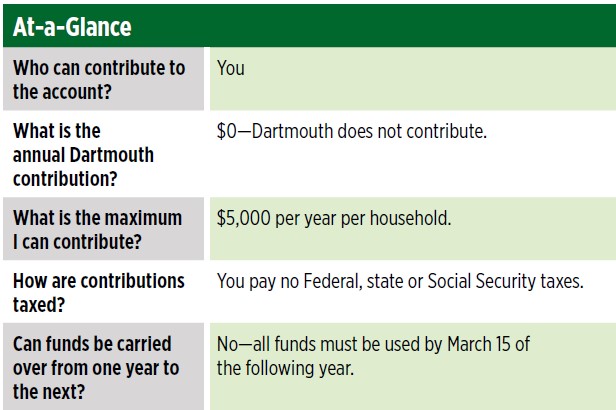

Allows you to use pre-tax dollars to pay for child care or care for an elderly or disabled family member.

Contact Sentinel Benefits

888-762-6088

https://www.sentinelgroup.com/

Sentinel Help Center

781-213-7301 (claims)

Create an Account

Set up your account with Sentinel and download the mobil app

1. Go to www.sentinelgroup.com (Chrome and Safari are the recommended browsers)

2. In the "I am an Individual" section, click on GET STARTED

3. From the LOGIN drop down, select "FSA, HSA, HRA, Commuter Accounts"

4. Under NEW USER select "Create your new Username and Password"

5. Enter your personal information

In addition, you can also upload the Sentinel Accounts App onto your mobile phone for ease in claim monitoring and claim submission.

Eligibility and Enrollment

- All benefits-eligible Faculty, Exempt, Non-Exempt and SEIU employees are eligible to contribute.

- Research Associate Bs and Research Fellows are not eligible to participate in the DCFSA.

- Married couples filing separately may only contribute $2,500 each.

- You may NOT contribute to a DCFSA or submit claims incurred while you or a spouse are not working (i.e., leave of absence, hiatus, unemployed).

- You MAY contribute to a DCFSA if you need child care in order to work remotely.

Unlike the HCFSA, the DCFSA limit is a true household limit and must be shared with other members of the household. Also, unlike the HCFSA, New Hires must take into consideration any amount previously contributed at former employers and by other household members when making a new annual election.

IMPORTANT NOTE: If you do not elect a contribution amount during your New Hire enrollment or during your annual open enrollment period, you will not be able to contribute to a Dependent Care FSA for the calendar year, unless you have a very specific type of qualified life event. Changes to your annual election can only be made during very specific life event circumstances as well.

Contribution Limits

Annual Limit per Household: $5,000

Married Couples filing separate: $2,500

Note: If you are are considered a highly-compensated employee in 2023, your limit will be capped at $3,258.00. Highly-compensated for 2023 is considered individuals who earned over $135,000 in 2022 or are projected to earn over $135,000 in 2023. (This cap is updated effective 8/15/2023 after completion of preliminary nondiscrimination testing performed as regulated by the IRS)

Important Filing Deadlines

3/15/23 - DCFSA Grace Period Ends - Last day to incur expenses submitted toward your 2022

DCFSA balance.

3/31/23 - FSA Runout Period Ends - Last day to submit 2022 incurred DCFSA claims to Sentinel

for reimbursement. 2023 incurred FSA claims filed after this point, will be applied

toward your 2023 account balance.

4/1/23 - No more 2022 incurred claims will be accepted by Sentinel. Any remaining 2022

balance will be forfeited.

You do not need to report FSA contributions or expenditures to the IRS through your annual tax return.

Understanding the Benefits

Flexible Spending Accounts are strictly regulated by the IRS. It is your responsibility to read and understand the information provided. For clarification about information on this webpage, please reach out to the Dartmouth Benefits office. If you have specific questions around the IRS' rules and regulations surrounding your FSA plan, you are advised to speak to your tax professional.

Sentinel has provided a quick start guide, to get you going. For more in-depth information about your plans and how they work, please read the information provided below.

Eligible Expenses

For a list of the IRS's eligible Dependent Care Expenses, please click here.

Key Benefits

- A Dependent Care FSA account is generally used to cover expenses for the care of a “qualified dependent” under the age of 13 while the you and your spouse are working or looking for work.

- Additional covered expenses include Elder Care and Caregivers for a disabled spouse or dependent who lives with the participant

- Expenses for dependent care are not medical, vision or dental expenses.

- Qualified dependent care expenses include:

- Child care services

- Nannies

- After-School Programs

- Summer Day Camps

- Adult Day centers for aging parents

- Nursing care for dependents with disabilities

- Funds are available as they are deposited

- You will receive a "Benny" debit card, which you can use to pay eligible expenses.

Dependents

Expenses must be for the care of a dependent who is:

- Under the age of 13 for whom the employee is entitled to a dependent deduction under the Internal Revenue Code Section 151(e), or

- a spouse, or

- other person who lives with the employee for more than half the year and who is physically or mentally incapable of caring for himself or herself

Plan Overview

Refer to page 22 of the 2023 Open Enrollment Guide.

How the HCFSA Benefit Works

Refer to page 22 of the 2023 Open Enrollment Guide.

DCFSA Payroll Deduction - Money comes out of your pay check each pay period, and goes into your DCFSA Account

at Sentinel Benefits, reducing the amount of taxes you pay each pay period.

DCFSA Payroll Deduction - Money comes out of your pay check each pay period, and goes into your DCFSA Account

at Sentinel Benefits, reducing the amount of taxes you pay each pay period.

DCFSA Account is Funded - Dependent Care accounts are funded through payroll deductions. The annual amount elected is available as funds are deposited.

Incur Eligible DCFA Expenses - Claims can be submitted for up to the full election amount and payments will be made based on available balance. If the claim amount is higher than the amount available, additional payments will be issued as funds are added to the account until the claim is paid in full.

Keep your DCFSA Receipts - You will need to keep your DCFSA receipts in case you are ever audited by the IRS, and for the purpose of filing claims to Sentinel for reimbursement.

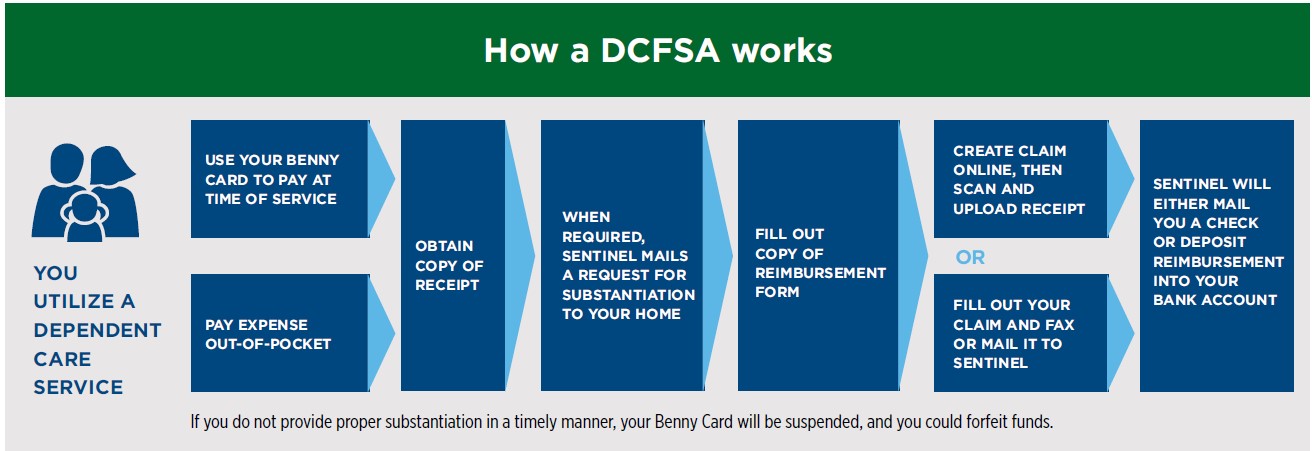

Submit/File a Claim - You will need to supply supporting documentation to Sentinel Benefits for the money that is paid through the Benny debit card, or the funds that you pay out of pocket and request for reimbursement. Your day care provider does not send copies of your invoices to Sentinel Benefits. See Filing a claim below.

DCFSA Deadlines - DCFSAs have deadlines regulated by the IRS. Any unclaimed balance remaining in your account at the end of the March 31st run out period will be forfeited. Please pay careful attention to the Important Filing Deadlines section above.

DCFSA Grace Period

The Dependent Care FSA has a 2.5 month grace period. A grace period is a timeframe in the new plan year during which you can incur new expenses and file claims. This timeframe is 2½ months after the end of the plan year (January 1st through March 15th) This means that you have until March 15th to incur new expenses and use money left in your 2022 Healthcare FSA to pay them.

Filing a Claim

As you deposit pret-tax funds into your DCFSA account, you can then claim them for reimbursement from Sentinel Benefits.

There are three ways to file/submit claims through Sentinel Benefits.

- Benny VISA Debit Card - Use the Sentinel Benny debit card to pay the day care provider at the time of service. Then submit a copy of the receipt and DCFSA claim form to Sentinel after the fact.

- Pay out of Pocket - Pay the day care provider out of pocket then submit a copy of the receipt and DCFSA claim form to Sentinel after the fact. Sentinel will reimburse you by check or or via direct deposit (typically within 3-5 business days).

- Unpaid Invoice - The IRS does not require that you show proof of payment to receive reimbursement. Send a copy of an unpaid day care provider invoice and Sentinel DCFSA claim form to Sentinel. Sentinel will reimburse you by way of direct deposit or paper check. You will then have funds available to pay your day care provider.

The following must be included with your claim submission:

1. Completed DCFSA claim form, including all claim information. Please note that the provider's Tax ID or Social

Security Number is REQUIRED to process the claim.

2. One of the following:

• Cancelled check or receipt from the caregiver detailing date(s) of service, name

of the service provider,

description of the expense/service, and amount charged; or

• Signature from caregiver certifying care provided

Leaving Dartmouth

COBRA - Unlike the Health Care FSA, you may not continue your Dependent Care FSA under

COBRA. Expenses incurred after the last day of coverage will not be approved. For

more information about COBRA benefits, please visit our Leaving Dartmouth webpage.

Runout Period (Deadline to Submit Claims) - You will still have the runout period through March 31st of the following year to

submit your expenses manually through Sentinel.

Submitting for Reimbursement - The process does not change. You will continue to submit expenses to Sentinel using

the claim form.

Claim Form - Use this form when submitting DCFSA claims.